🔴 Trump’s Actions Trigger a Crash in Crypto and Stock Markets

🔻Bitcoin has dropped below $75,000, with the total cryptocurrency market capitalization falling by 12.8% in just 24 hours.

🔻China’s stock market opened with a 10% decline due to Trump’s new tariffs — the biggest single-day drop since 2008.

🔻Oil prices for Brent and WTI have been plummeting since the start of trading in Asia. Brent, in particular, has fallen below $64 per barrel — a level not seen since April 2021.

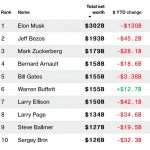

🔻In just two days, $5 trillion has vanished from the global markets — an event that has occurred only four times in the past 85 years. The cause: Trump’s trade war.

Economists warn that a second “Black Monday” may be approaching — a repeat of the market collapse that happened in October 1987.

tcoin Dips Below $100K Amid Rising Trade Tensions

Bitcoin’s price has slipped under $100,000 for the first time since January 27, following the U.S. decision to impose new import tariffs on goods from China, Canada, and Mexico. The tariffs, initiated by former President Donald Trump, have prompted immediate retaliatory measures from all three countries, intensifying global trade tensions and shaking investor confidence.

Tether’s USDT and Bitcoin: A Decade of Correlation and Market Shifts

Over the past ten years, the issuance and burning of Tether’s USDt (USDT) have closely mirrored Bitcoin’s price cycles. Data from Whale Alert reveals how aggressive USDT minting typically clusters around bullish trends, while token burns often follow market corrections.

A detailed timeline provided by Whale Alert charts the relationship between Bitcoin prices and net USDT issuance from 2015 to early 2025. While crypto analysts have long speculated on the connection, this dataset delivers clearer evidence and context.

As the world’s largest stablecoin with a market capitalization exceeding $144 billion, USDT is a cornerstone of crypto liquidity. It often serves as a proxy for capital inflows, signaling investor sentiment and market momentum.

Crypto analyst Mads Eberhardt explains that rising stablecoin supply—particularly Tether—has historically correlated with positive market trends. This was evident throughout 2024, when major USDT issuances accompanied or preceded surging Bitcoin prices.

In late October and November 2024, Tether minted tens of billions in USDT, aligning with Bitcoin’s jump from $66,700 to over $106,000. Additional mints in mid-November contributed to Bitcoin reaching $99,000 and later peaking in December.

However, experts caution against interpreting this correlation as causation. Ki Young Ju, CEO of CryptoQuant, emphasizes that today’s liquidity often flows through ETFs and OTC desks rather than directly via stablecoins. He notes that the total stablecoin reserves on exchanges remain below their 2021 bull market levels.

USDT redemptions typically occur during or after Bitcoin downturns, reflecting reduced demand and market cool-downs. Whale Alert highlighted several such events, including a $20 billion burn in June 2022 during Bitcoin’s sharp drop.

Although Tether’s issuance trends offer valuable market signals, their predictive power is still debated. With regulatory frameworks evolving and alternatives like USDC and DAI gaining traction, stablecoin dynamics are shifting.

Ultimately, the future influence of USDT minting and burning on Bitcoin and broader crypto markets will depend on how global regulations, institutional adoption, and user behavior continue to evolve.